trust capital gains tax rate 2022

4 hours ago1 Includes the most recent monthly distribution paid on April 18 2022. Instead of the annual.

How To Pay 0 Capital Gains Taxes With A Six Figure Income

According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022.

. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. There are seven federal income tax rates in 2022. Capital gains taxes are paid when you realize a gain on the sale of an asset.

For tax year 2022 the 20 rate applies to amounts above 13700. 2021 Long-Term Capital Gains Trust Tax Rates Tax documents Short-term capital gains from assets held 12 months or less and non. 5 rows The proposal by House Democrats would also add a 3 percent tax on those who have modified adjusted.

The maximum tax rate for long-term capital gains and qualified dividends is 20. 2022 Long-Term Capital Gains Trust Tax Rates. Events that trigger a disposal include a sale donation exchange loss.

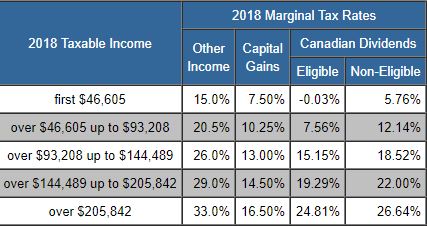

Therefore a portion. On April 7 2022 Budget Day the Minister of Finance introduced Canadas 2022 Federal Budget Budget 2022. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a.

Since the amended AGI is less than 200000 the recipient is not subject to the 38 NIIT. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

A trust can generally deduct all cash donations to a. While taxpayers may be relieved that Budget 2022 does not include an increase to the capital gains inclusion rate or restrictions on the principal residence exemption Budget 2022 does include a number of significant changes applicable to financial. The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year.

The 0 and 15 rates continue to apply to amounts below certain threshold amounts. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. For example if you purchased real property for 400000 and sold it ten years later for 500000 you would realize a gain of 100000.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Capital Gains Tax Rate 2022.

The problem in turn is that few customers want these trust automatic distributions to be made to their children or. In certain circumstances it may also be possible to distribute the trusts capital gains to beneficiaries to avoid the higher rates of capital gains that usually apply to trusts as well as the net capital gains tax of 38. Capital Gains Tax Rate 2022.

7 hours agoThe answer is relatively simple considering the tax code is estimated to be at least 70000 pages. Capital gains tax will be raised to 288 percent by House Democrats. 2022 Capital Gains Tax Rates On Trusts Capital Gains Tax Rate 2022 It is widely accepted that capital gains are the result of earnings generated by the sale of assets like stocks or real estate or even a business and they are tax-deductible income.

Avoid Capital Gains Tax on Real Estate in 2022. The 0 rate applies to amounts up to 2800. Trust Tax Rates On Capital Gains 2022 Capital Gains Tax Rate 2022 It is widely accepted that capital gains refer to earnings realized through the sale of assets such as stocks real estate or a company and that these profits constitute tax-deductible income.

The highest trust and estate tax rate is 37. 2022 Capital Gains Tax For Trusts. Of this amount 59600 is subject to normal tax rates up to 22 and 40000 is subject to capital gains tax rates 15.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Capital Gains Rates 2022 Trusts Capital Gains Tax Rate 2022 It is widely accepted that capital gains are gains generated by the sale. Net operating loss deductions and the.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. For trusts in 2022 there are three long-term capital. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income.

20 for trustees or for. When it comes to determining the amount you have to pay to tax on these gains much depends on the length of. 2021 Long-Term Capital Gains Trust Tax Rates Tax documents Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary.

2 The Fund estimates that it has distributed more than its income and net realized capital gains. The rates are much less onerous. However long term capital gain generated by a trust still maxes out at 20 plus the 38 when taxable trust income exceeds 13050.

Capital gains tax would be raised to 288 percent. Capital gains and qualified dividends. Capital Gains Tax Basics.

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

2022 Trust Tax Rates And Exemptions Smartasset

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Reporting Capital Gains Dividend Income Is Complex Morningstar

Capital Gains Tax Calculator 2022 Casaplorer

Pin By Larry Oliver Reed On Investing Investing Income Tax Brackets Capital Gains Tax

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Reporting Capital Gains Dividend Income Is Complex Morningstar

Taxtips Ca Canada Federal 2017 2018 Income Tax Rates

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What Is Investment Income Definition Types And Tax Treatments

What Is Capital Gains Tax And When Are You Exempt Thestreet

Crypto Tax Rates Complete Breakdown By Income Level 2022 Cryptotrader Tax

12 Ways To Beat Capital Gains Tax In The Age Of Trump

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Cryptotrader Tax

Capital Gains Rates Before And After The New Tax Law Kwc Virginia Accounting Firm

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets