refinance closing costs transfer taxes

It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. The only settlement or closing costs you can deduct are home mortgage interest and certain real estate taxes.

Mortgage Closing Costs For Buyers True North Mortgage

Average refinancing closing costs are 5000 according to Freddie Mac.

. Does not apply to refis just purchased in PA. Not a single penny. State laws usually describe transfer tax as a set.

Closing costs that can be deducted over the life of your loan. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Many states charge a feetax when a home is.

Transfer Tax -1 5 County 5 State Property Tax 0883 per hundred assessed value 1012 County 132 State MONTGOMERY COUNTY 240-777-8950 Recordation Tax. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Your Guide To 2015 US.

These are not allowed to change so if you see a. Minimum FHA Credit Score Requirement Falls 60 Points October 11. Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes.

Learn More Apply Today. Ad Make the Right Choice With the Help Of Our Listings. Our Home Loan Experts Can Help.

70 cents per 100 Documentary Stamps State Tax on the. Apply Get Pre Approved In 24hrs. How to Pay Closing Costs When Refinancing Your Mortgage.

Ad Compare Top Mortgage Refinance Lenders. Other closing costs are not. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Try Our Fast Easy Online Mortgage Application. Refinance Today Save Money By Lowering Your Rates. It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save.

Homeowner Tax Deductions. Much like when you first purchase a home there are refinance tax deductions you can claim after refinancing the mortgage loan on your rental property. Compare offers from our partners side by side and find the perfect lender for you.

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. Ad Compare the Best Refinance Mortgage Lender that Suits Your Needs with No Closing Costs.

You deduct them in the year you buy your home if you itemize your deductions. Well Automatically Calculate Your Estimated Down Payment. National average closing costs for a.

Ad Buying A Home. Your lender does not know what they are doing. No closing costs including the below are not tax deductible but may increase the cost basis of your home which may benefit you in the event of sale.

You closing costs are not tax deductible. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing. If you cant take tax deductions for buying a house in the year the closing costs are paid you still may be able to.

For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year. Compare Cash-Out Refinance Rates. Transfer taxes are not tax-deductible against your income.

Since this is a refinance there are no closing costs associated with acquisition of the property. Special Offers Just a Click Away. Call us for a quote 2675144630 x1.

Ad Curious How Much You Will Need To Pay In Closing Costs. You cant deduct more than. Get An Affordable Mortgage Loan With Award-Winning Client Service.

So theres nothing from those costs to add to the cost basis. Purchasing A Home In Florida Florida Refinance. Your Loan Should Too.

Youll typically pay mortgage refinance closing costs equal to between 2 and 6 of your loan amount depending on the loan size. The national average closing costs for a single-family property refinance in 2021 excluding any type of recordation or other specialty tax was 2375. You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined.

10 Best Home Refinance Compared Reviewed. Lender fees including origination charges and underwriting fees make up a big chunk of your closing costs.

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Land Transfer Tax In Ontario Ratehub Ca

What Is A Loan Estimate How To Read And What To Look For

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Toronto Land Transfer Tax Calculator Rates Rebates

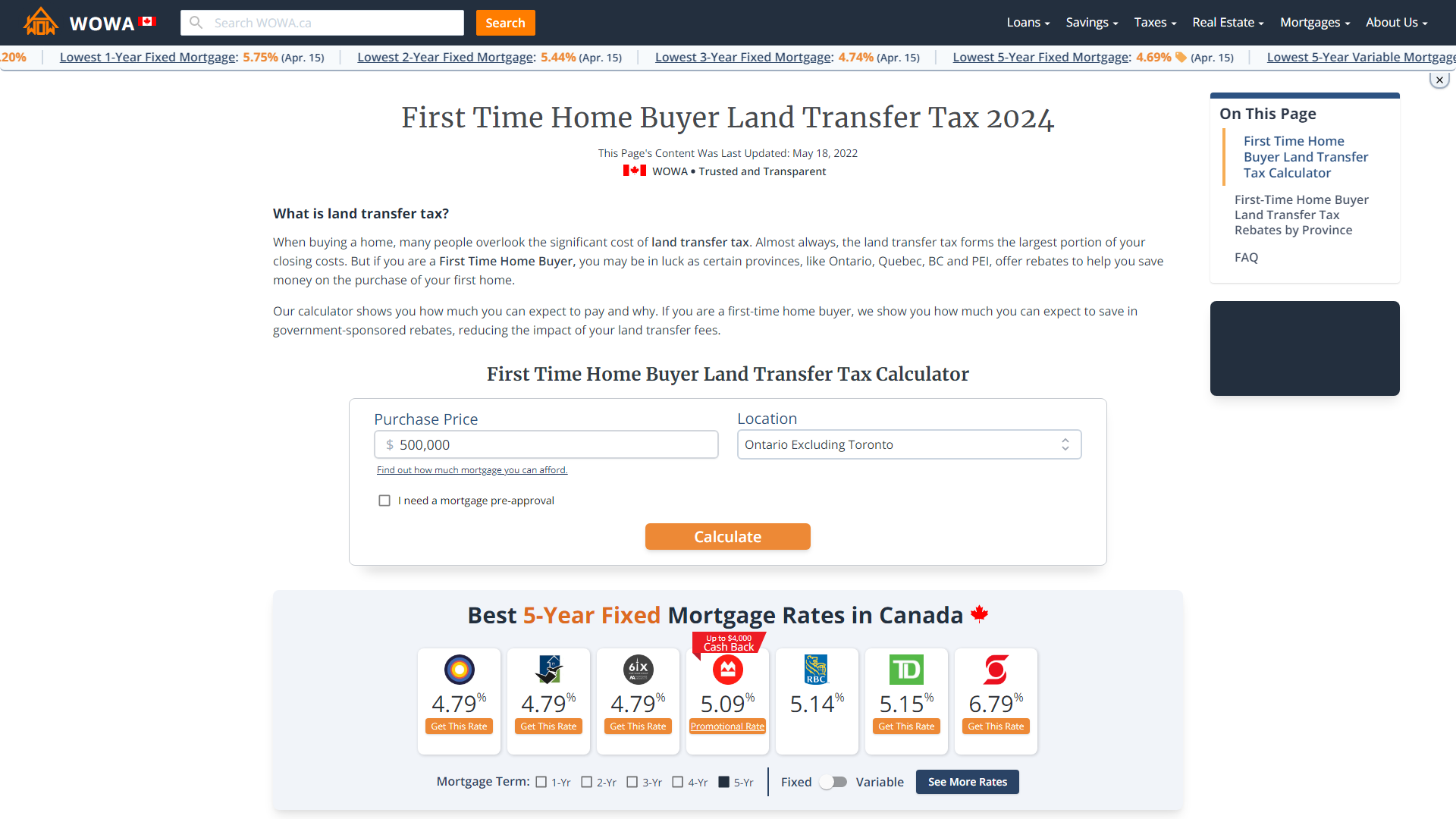

First Time Home Buyer Land Transfer Tax Rebate Criteria

Reducing Refinancing Expenses The New York Times

Closing Costs That Are And Aren T Tax Deductible Lendingtree

A Guide To Closing Costs In Canada Another Loonie

Closing Costs Ontario You Must Know Before Buying Or Selling Property

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gr Real Estate Tips Real Estate Infographic Real Estate Investing

6 Typical Closing Costs In Ontario Wahi

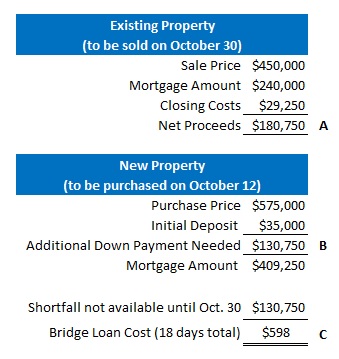

Bridge Financing A Solution When Buy And Sell Dates Don T Overlap Dave The Mortgage Broker

Land Transfer Tax Calculator For Canadian Provinces 2022 Wowa Ca

Mortgage Closing Costs For Buyers True North Mortgage